With the approval of 11 Bitcoin spot ETFs by the U.S. Securities and Exchange Commission (SEC) on Wednesday (10th), the market is now turning its attention to the approval time of Ethereum spot ETFs. According to a report by Cointelegraph, Bloomberg ETF analyst Eric Balchunas believes that the probability of Ethereum spot ETF approval in May this year is as high as 70%.

Balchunas previously told Cointelegraph that he couldn’t imagine a scenario where a Bitcoin spot ETF was approved but an Ethereum spot ETF was not, and he also heard through unofficial sources that there “should be no problem” with the Ethereum spot ETF.

Meanwhile, digital asset lawyer Joe Carlasare also believes that the Ethereum spot ETF will be approved this year, but the process “will take longer than people expect.”

Balchunas said he estimates that there is a 70% chance the Ethereum spot ETF will be approved before May (SEC will make final decisions on several applications that month), but he also noted that the specific launch time is not yet clear.

Carlasare believes that the Ethereum spot ETF will not start trading until the third quarter of 2024, while one of the ETF applicants, Hashdex, recently stated that this Ethereum investment product will start trading in the second quarter at the earliest. Steven McClurg, Chief Investment Officer of Valkyrie Funds, expressed that he would not be surprised if the Ethereum spot ETF and XRP ETF are listed after Bitcoin is approved by the SEC.

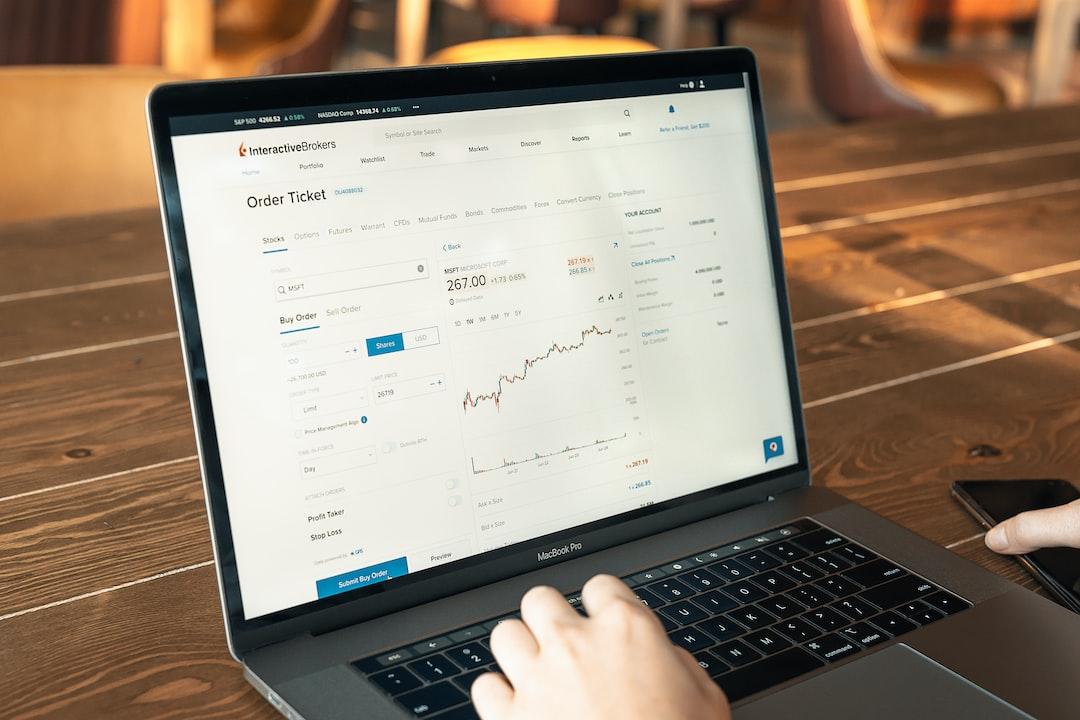

Following the news of the approval of the Bitcoin spot ETF, the price of Ethereum (ETH) has risen by about 5% to surpass $2,600 before the publication of this article, reaching a new high since May 2022.

ETH price trend in the past year (Source: TradingView)